Pearlmark announced, in partnership Waterton, that it had closed a $53.2-million mezzanine loan for the development phase of South Pier, a waterfront multifamily project in Tempe Town Lake, Arizona. The project will be comprised of three towers with 724 luxury units, a parking garage of 850 stalls and surface parking of 280 stalls. It will also include 26,500 square foot of commercial space on the ground floor.

The McBride Cohen Company (McBride Cohen), a leading real estate developer, leads the project development through its CEO and owner Loren McBride Cohen. The Davis Experience is the project architect, and Clayco is the general contractor. The first phase of the project was completed in Spring 2026. Construction began on January 20, 2023.

The closing of this deal has significantly boosted our mission to deliver a world-class destination waterfront in the Phoenix Valley,” Loren McBride Cohen said, owner and CEO at McBride Cohen. “We appreciate the trust that Pearlmark has placed in our vision of this historic project.”

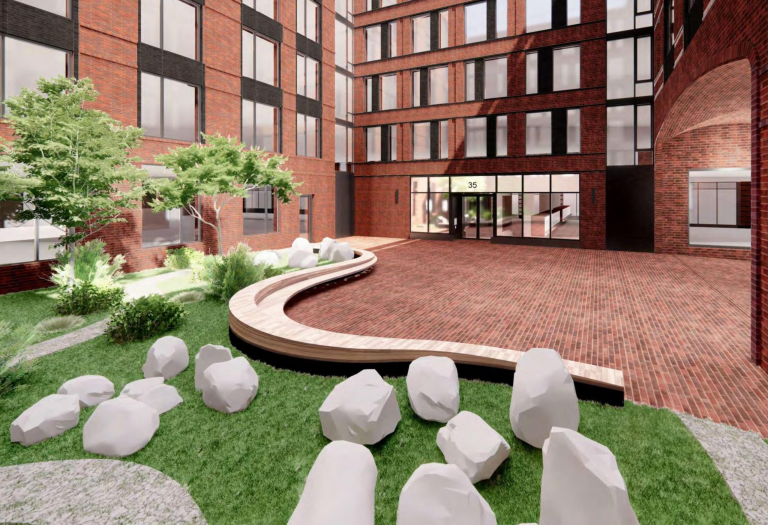

McBride Cohen, the master developer, is responsible for South Pier at Tempe Town Lake. This seven-phase resort-inspired project spans over 18 acres, and covers 3.2 million square foot, on nearly one mile along the southern shoreline. Site is adjacent to Arizona State University’s main campus with its 85,000 student population. The mixed-use multi-billion dollar project will transform Tempe Town Lake, transforming it into a vibrant waterfront neighborhood with 24/7 uses in 18 buildings. It will be built in phases, over 8-12 years. The future phases will feature thousands of new housing units, 600,000 square foot of Class-A high-rise office space, and two luxury hotels. They will also include the South Pier Isle – a world-class entertainment district that offers dining, shopping, and nightlife experiences. It features restaurants, cafes and nightlife venues, live-events spaces, world-class fountain shows, and an 80-meter tall observation wheel. The project site is within an IRS-designated Qualified Opportunity Zone. It will create a luxury waterfront entertainment destination for the growing Phoenix Valley metropolitan area.

The mezzanine loans were originated by Pearlmark, on behalf of Pearlmark Mezzanine Realty Partners V, L.P., and a mixed investment vehicle managed Waterton. Banco Inbursa is a Mexico City bank founded by Carlos Slim. Cantor Silverstein, an investment joint venture between Silverstein Properties, Cantor Fitzgerald and McBride Cohen funded the equity for the first phase of the project. Jones Lang LaSalle’s Seattle office, headed by Tom Wilson, provided advice to the project sponsors regarding this capitalization.

Bill Swackhamer arranged for Pearlmark to complete the deal with Waterton. Bill Swackhamer, Managing Director of Pearlmark, arranged the transaction for both Waterton and Pearlmark.

Julie Heigel is Vice President of Waterton’s Acquisitions. She stated, “We are thrilled to work with such an experienced sponsor group and diversify the investment portfolio.” It’s been a pleasure to work with Pearlmark on this project and bring it to life.

Doug Lyons is the Managing Principal of Pearlmark’s Debt Investments. He added, “The experience of McBride Cohen Silverstein and Cantor Fitzgerald, as well as their significant capital commitments, gave Pearlmark and Waterton an extremely high level of trust in this large, complex luxury multifamily housing project.”

+ There are no comments

Add yours